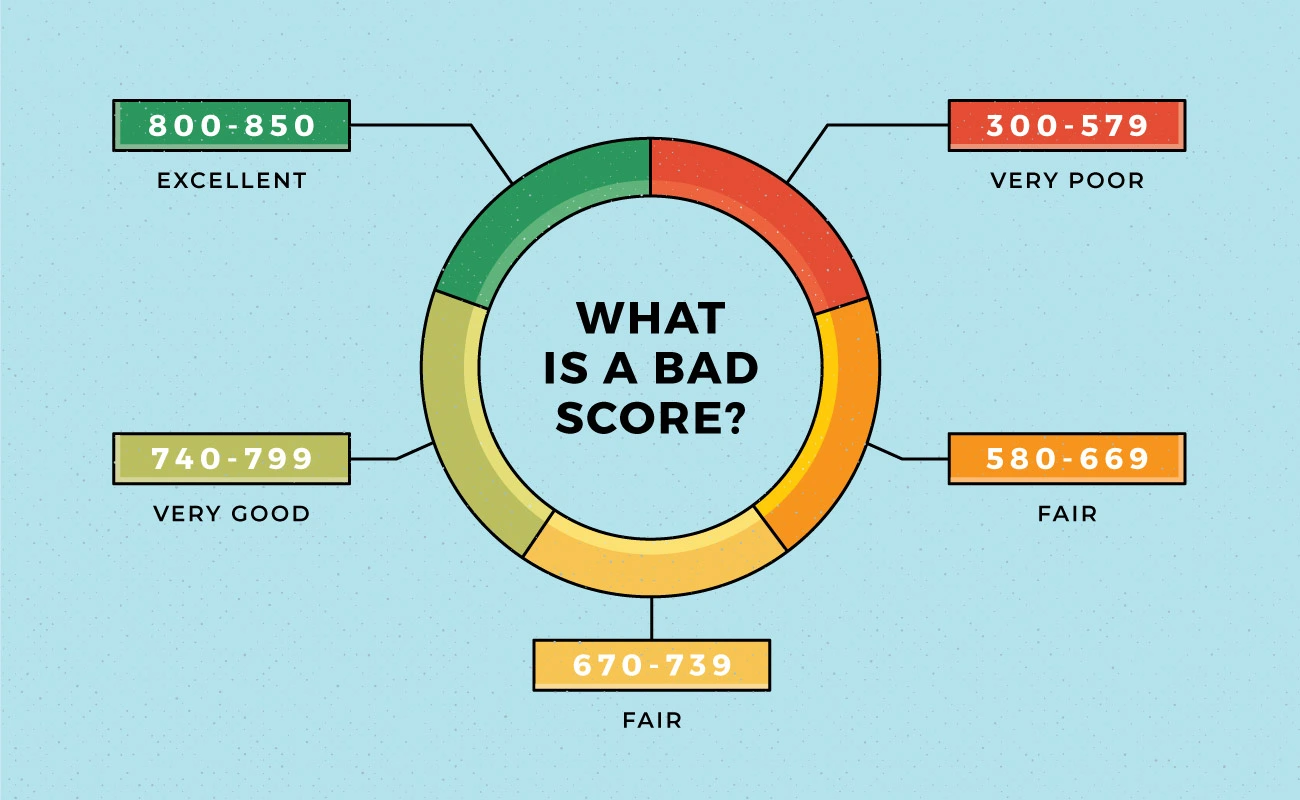

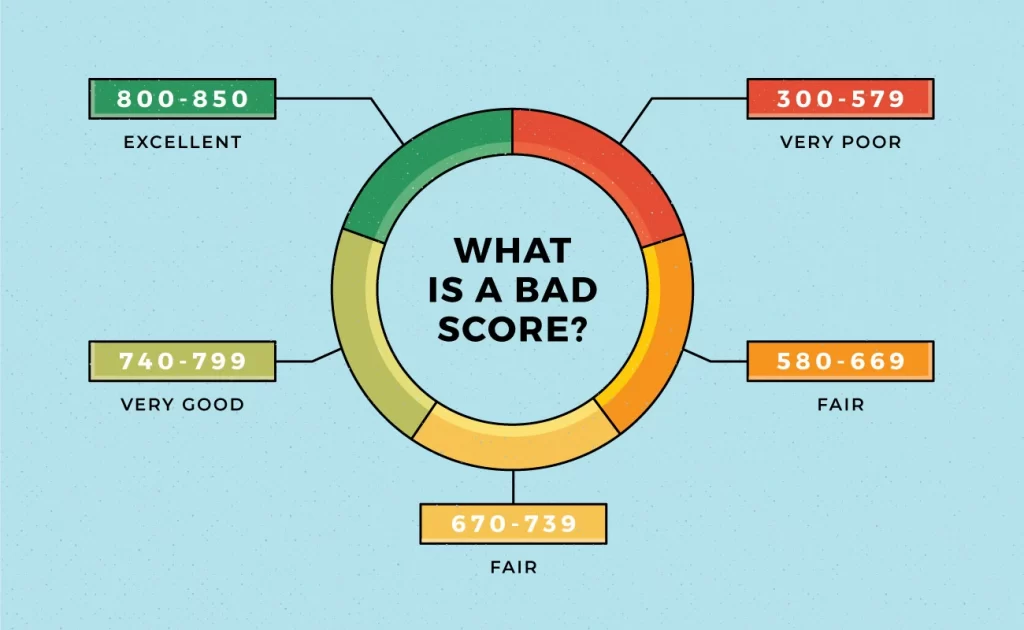

Do You Have A Bad Credit Score? Here’s What You Need To Know!

There are multiple disadvantages of having a bad credit score. The majority of American consumers have a good credit score or higher, but reaching such goals can be more challenging. The CNBC selects cover the largest challenges of having a bad credit score and ways to break such a routine.

The perfect credit score can help you to get Online loans can provide emergency cash immediately. Besides that, consumers are served with access to premium credit cards, the most acceptable loans with multiple favorable interest rates. Such aspects show that people should try to maintain the most exemplary score to ensure better and more favorable outlets.

However, a bad credit score can enable you to face multiple difficulties, and it can easily delay retirement, which costs you more money over time. But there is nothing to be scared of as you provide various ways to improve your score and avail superior quality outlets.

Such goals can be obtained by understanding the concept of credit score and ways to improve it to get numerous benefits. If you want to break from a bad credit cycle, you must check out the listed aspects. Take a look here: –

- More payment for loan: –

- The exquisite credit score will help you with the bank and other reputable institutions that are going to provide you with special interest rates on multiple loans. According to Ulzheimer, the clients can get awesome deals on APR for their auto loans along with a credit score of 720 or more.

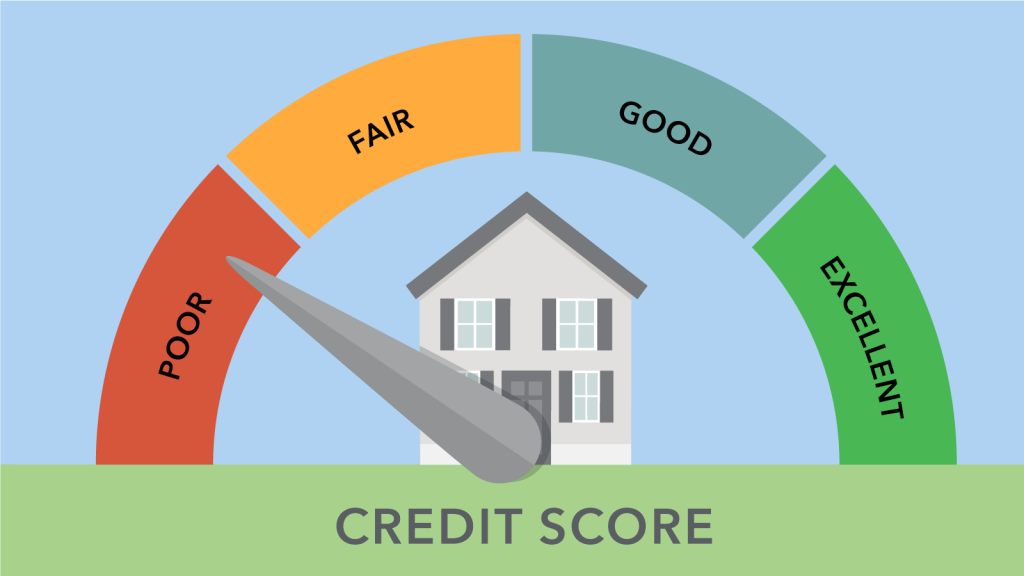

- If you are willing to apply for a mortgage with a FICO score of 620, you need to pay about 4.8% interest and the current rates. Besides that, the buyers with a great score like 760 or 850 are capable of borrowing 3.2% APR.

- There is a massive 1.6% difference between the low and higher credit scores. It will impact the percentage of interest, and people with lower scores need to pay more money than the higher credit score holders.

- Risk for the mainstream: –

- The banks have rigorous standards that help them determine the capability of getting qualified for lending. However, it might not let you qualify for common or standard loans or credit cards.

- If you are dealing with a bad credit score, the practical effect can impact your access to mainstream funding. But before you seek help from lenders that are less-than-reputable sources like pawn shops, payday loans, and title loan companies, the Ulzheimer usually focuses on reading the finest print.

- For example, the easier and fastest way to get cash is if you are in a bind, but it usually discloses that APR can be higher, like 400% to 700%. It can be avoided as the clients are served with a great choice between a $10,000 personal loan. It is evident that the mainstream leader will be helping with fantastic deals and better results.

- The insurance premium: –

- Numerous states in the U.S. allow people to get credit based on their insurance scoring. It offers you great auto and homeowners insurance companies that permit the factor to your money habits and assessment of risk.

- Besides that, the clients are proficient in dipping their credit score, and it will not increase the premium, and the policy will be canceled if the score drops from 600. So a bad credit score enables you to get prevention from the lowest possible rate.

- If you want to see the score based on the credit insurance, you need to request a report. Unfortunately, rare people are aware that credit-based insurance scoring is banned in Hawaii.

- Trouble renting an apartment: –

- If you have a credit score of 620, it is pretty common to find an apartment. Some landlords and property management firms or companies are stricter than others. It ensures that you are offered with ease to explore perks if you have a score of 700 or above.

- But with the poor score, you might need to deal with numerous issues and find a cosigner or need to prefer paying the security deposit before getting or signing up the new lease. It is pretty impossible to rent any place or apartment with a bad credit score.

- Miss career opportunities: –

- Satisfactory credit scores can set up excellent career opportunities. In multiple states, employers are enabling clients to pull credit reports to make hiring decisions and even while deciding to reassign and promote.

- The employer isn’t going to see your accurate credit score, but with the assigned permission, they can access the credit report and get the required information. Such information includes auto loans, outstanding balances, past foreclosures, missed payments, collection, and bankruptcies.

- The rewards: –

- The remarkable rewards of credit cards are the ones that can be obtained by having the highest credit score. When the client’s score is excellent or good, they are enabled to get remarkable introductory offers, cashback incentives, and more.

- The higher-tier credit cards are the ones that give people some unique invitations to impressive concerts and pre-sale events. In addition, the rewards offered to clients in the form of cashback can be obtained via streaming services and more.

At last, a bad credit score can enable you to deal with long-term impacts on financial life and it is advised to get such issues resolved.