0 Interest Credit Card Consider The Details

When it comes to credit cards, getting a 0 interest credit card is about as terrific a deal as you are going to get. There are a variety of companies that offer such sweet deals. Some examples of these include Citibank, American Express, Discover, Fleet and First USA. For those who have excellent credit this is a good deal for sure. You cannot get any better than zero interest.

You can follow the details for the purchasing of the cvv for the credit cards. You can gather complete information about on how to Buy Cvv to get the desired results. There is a need to take benefit of the credit cards to have the best experience. There is meeting of the needs and requirements of the users.

You need to tread carefully however when it comes to a credit card deal such as this. Don’t get so excited that you end up making a mistake that could cost you. First of all be aware that just because you got sent a zero percent offer does not mean that you will qualify for it in the event that you decide to apply for it. Credit card companies send offers to whoever appears on their list. They are not aware of your credit history when they do so.

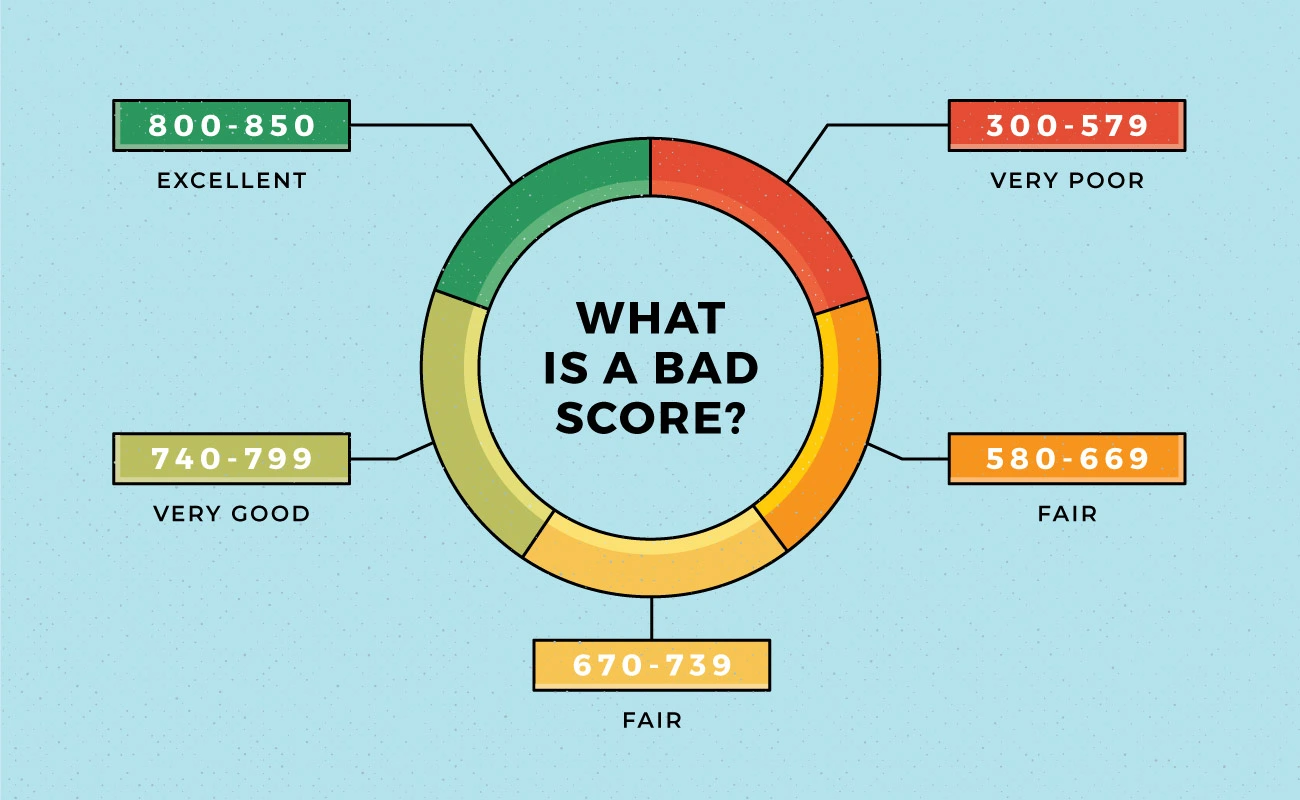

If your credit is poor and you are prone to making late payments or tend to skip months all together then your chances of being accepted are small to none. In order to qualify for a 0 interest credit card your credit must be good to excellent. Sometimes even fair does not cut it. Companies will not be willing to take chances on people who are bad risks.

At the same time if you tend to jump around from one credit card to another and are constantly transferring balances then any late payments, missed payments or paying less than the minimum required is not going to put you in anyone’s good graces. Bear in mind that your credit report will tell the tale even if you do not want to. As well, credit card issuers value loyalty in their customers. If they see that you have bounced from one credit card to another then they will save their offers of zero interest for someone who is more likely to stick around for the long-term.

You Qualify! – Now What?

You have good credit and a company has decided to take a chance on you. Congratulations! Before you jump for joy and decide to start using your new card you need to zero in on the small details. How long does the interest-free introductory period last for? Is it in place for purchases you make or balance transfers or could it be both? What type of interest rate will be put into place once the introductory period is over? These are all things you need to find out about.

You need to consider fees as well. For example if you choose to do a balance transfer some companies will charge you. Citibank and First USA are two such companies. They charge a fee that works out to be three percent of the balance that is about to be transferred. Always become aware of these details before you start using your 0 interest credit cards for purchases.