The Impact Of Business Credit Vendors On Business Loan Approvals And Interest Rates

In today’s competitive business landscape, securing funding is a critical aspect of ensuring growth and success. Whether you’re a startup looking to get off the ground or an established company seeking expansion capital, obtaining a business loan can be a game-changer. However, the road to approval and favorable interest rates is sometimes complicated. One crucial factor that can significantly influence your chances of success in this endeavor is your choice of business credit vendors. In this article, we will explore the impact of business credit vendors on business loan approvals and interest rates, focusing on tier 3 credit vendor analysis.

Understanding the Role of Business Credit Vendors

Business credit vendors play a pivotal role in the loan application process. They provide lenders with valuable insights into your company’s creditworthiness, financial stability, and payment history. This information helps lenders assess the level of risk associated with extending credit to your business. When you apply for a business loan, lenders may request a business credit report from one or more of these vendors to evaluate your credit profile.

The Tier 3 Credit Vendor Analysis

Tier 3 credit vendors are an essential part of the credit reporting ecosystem. While they may not be as widely recognized as major credit bureaus like Experian, Equifax, and TransUnion, they play a vital role in providing specific and niche credit data. These vendors often focus on industry-specific information, trade credit, or alternative credit data sources, which can offer a more comprehensive view of a business’s creditworthiness, especially for smaller enterprises.

Here are some key points to consider regarding tier 3 credit vendor analysis and its impact on business loan approvals and interest rates:

Diverse Data Sources: Tier 3 vendors gather data from various sources, including suppliers, vendors, and industry-specific databases. This diverse data can provide a more holistic view of your business’s financial health, which can be especially beneficial for companies with limited credit history.

Customized Risk Assessment: Tier 3 vendors may offer more customized risk assessment models tailored to specific industries. This can help lenders make more informed lending decisions, increasing your chances of loan approval.

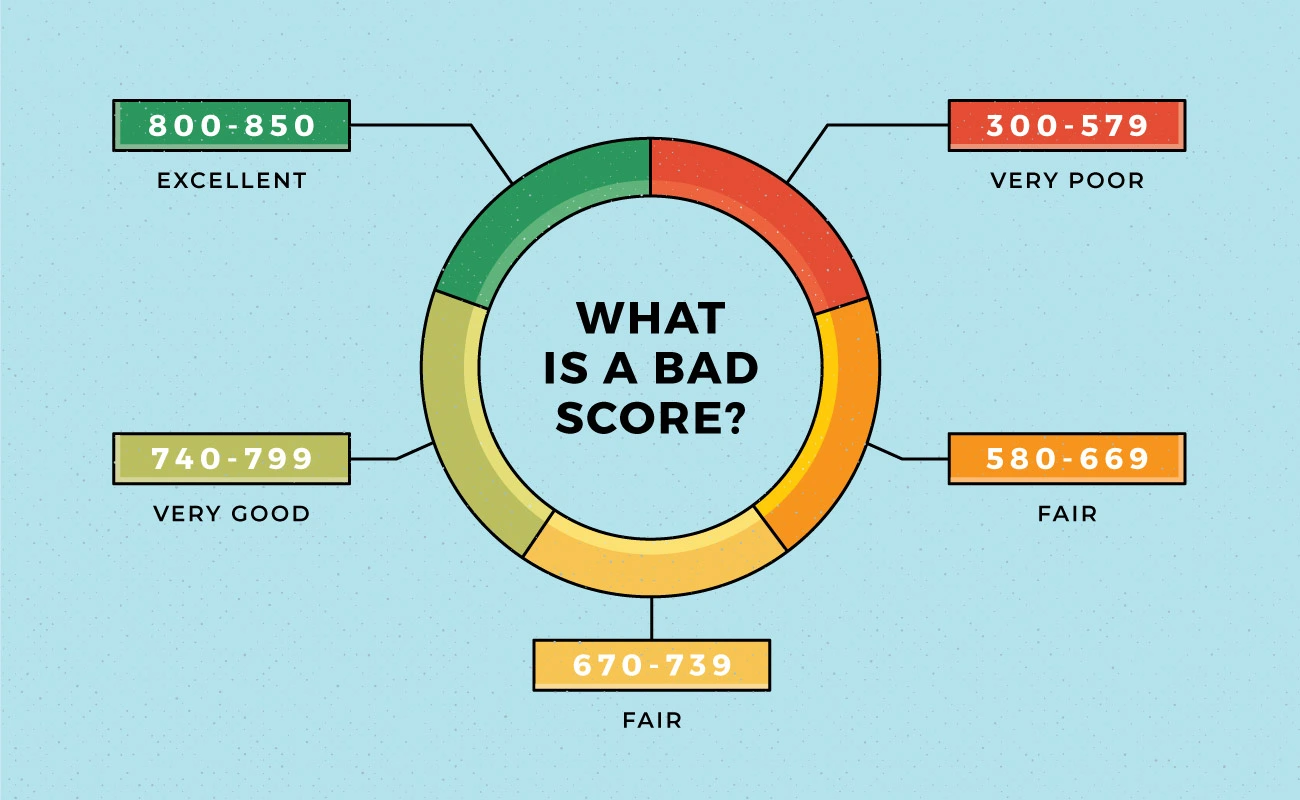

Credit Score Variation: Different credit vendors may generate slightly different credit scores for your business based on their unique data sources and algorithms. Understanding these variations can be crucial in securing the best loan terms.

Interest Rate Negotiations: A strong credit profile, supported by data from tier 3 vendors, can give you leverage when negotiating interest rates with lenders. Lenders may be more inclined to offer lower rates to businesses with lower perceived risk.

Credit Monitoring and Improvement: Tier 3 credit vendors often provide tools and services for monitoring your business credit and identifying areas for improvement. Proactively managing your credit can lead to better loan terms over time.

Leveraging Niche Data: Businesses in specialized industries or those with unique credit situations can benefit significantly from tier 3 credit vendor data. It allows lenders to understand the nuances of your business better and make more accurate lending decisions.

In conclusion, the impact of business credit vendors on loan approvals and interest rates must be balanced. Utilizing tier 3 credit vendor analysis can provide a competitive edge in securing financing for your business. By understanding the unique data sources and insights they offer, you can optimize your credit profile, improve your loan approval chances, and secure more favorable interest rates, ultimately contributing to the growth and success of your business.