What is the Process of Credit Score Repair?

As more of us get enslaved by debt, the credit ratings may suffer as a result. As you may be aware, your credit score is the most crucial consideration when getting massive expenditures such as purchasing a home, obtaining an auto loan, or obtaining any other form of a loan. However, moving out of this crippling debt is only half the battle.

Where to receive information from financial reports is always the first step in any credit restoration guide. Many businesses collect data regarding you and your payment history. Credit repair companies seek data about you and then offer it to borrowers. To repair your bad credit is necessary for every user.

How Do Credit Repair Firms Operate?

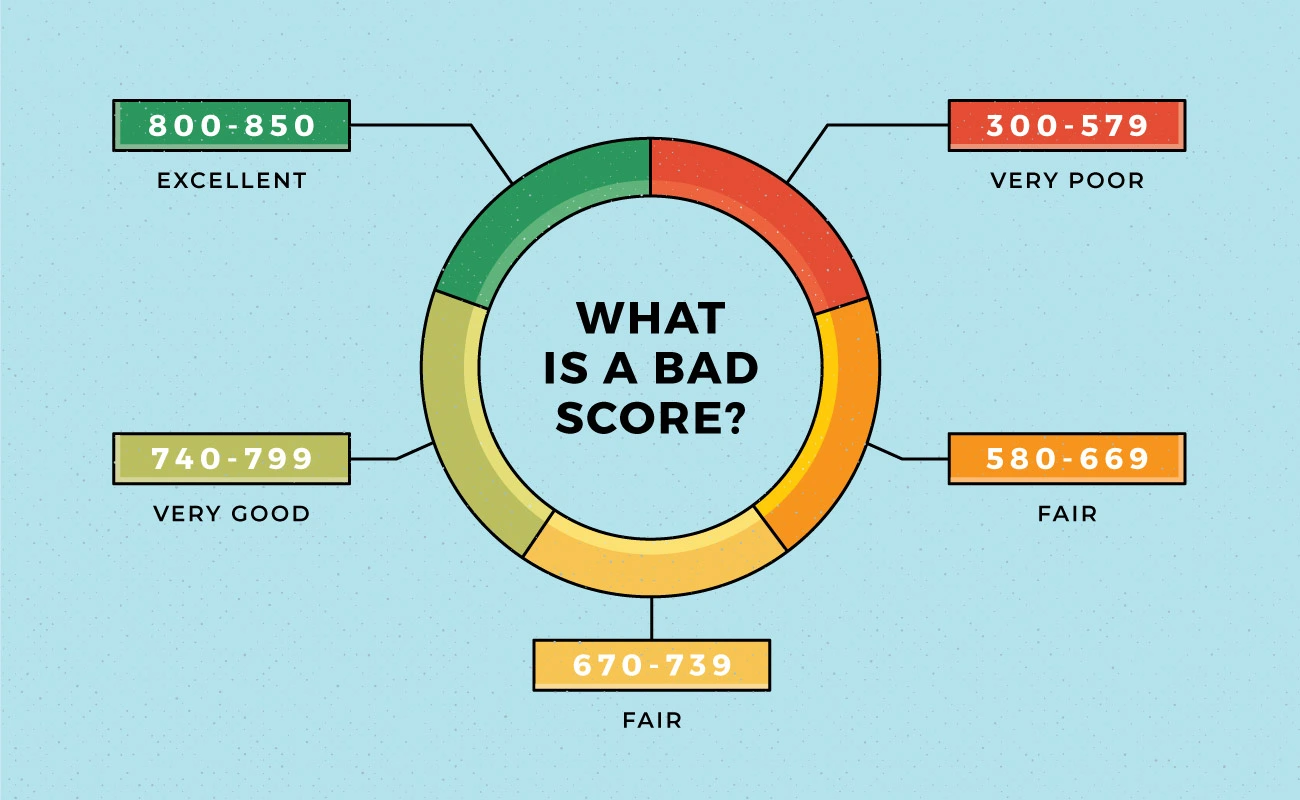

The preparation and acceptance of a credit card request are heavily influenced by the credit score. Your application may suffer as a result of a poor score. If you have a low credit score, you should work to raise it, so you don’t have difficulty believing the borrower. What steps can you take to improve your credit score? What may have gone horribly wrong to cause the score to drop? Is a credit repair company able to assist you?

A credit repair company is a firm that assists individuals in repairing and improving their credit scores. Clients may lack the necessary expertise and time to register their objections for a credit score modification. Credit repair services can assist such individuals in filing their challenges. When entrusting your personal details to a credit counseling firm, make sure to check their legitimacy. According to the Federal Trade Commission, a lot of agencies are unlicensed and aim to defraud customers.

Take the following steps

- False data

You can file a complaint on the relevant credit company’s website when you’ve identified the misleading data. There will be no alterations to your analysis if borrowers certify that the information provided is accurate. In this instance, you’ll need to speak with the lender directly to obtain an explanation.

- Having financial difficulties

If your payment is missed due to true financial difficulties, loss of employment, or an unexpected catastrophe, you can make up the difference when your financial condition improves. It is also a good idea to let your lender know about your financial circumstances so that they don’t take any further legal proceedings that could harm your credit.

- Relocation inside the country

When relocating, it is just as necessary to move your mortgage and credit lines as it would be to convert your deposit account. Ensure your creditors are aware of your plans to relocate. If you don’t, you could end up paying a lot of money in late penalties, processing fees, and unpaid bills.

Your credit score will also suffer as a result. It is essential to keep the bank account connected to your loan or mortgage at all times, including after you’ve relocated. If you discover a fraudulent activity indicated in the data, contact the lender involved.