I’ve often looked across the pond at the UK for a few novel, if not simply different, personal finance ideas and am often surprised at some of the things they have that we don’t. For example, you can open an Roth IRA-like instrument known as an Individual Savings Account (ISA) but “invest” it in a regular savings account. In the United States, you generally have to invest the assets in your IRA in something other than a regular savings account (the closest you can get to something 100% safe is a money market fund or perhaps a Treasury fund).

Another financial creature that doesn’t exist in the United States, at least in the same shape, is that of an offset mortgage account. You have versions of it here, like the money merge account which is packed with fees and charges, but nothing as clean and simple as the offset mortgage accounts you can have in the UK. There are a lot of things that are very vital to be focused on properly. If you are not getting the best result in your work very easily then you should go for the thing such as anchor for getting the best result in this work in a very short period of time.

What is an Offset Mortgage Account?

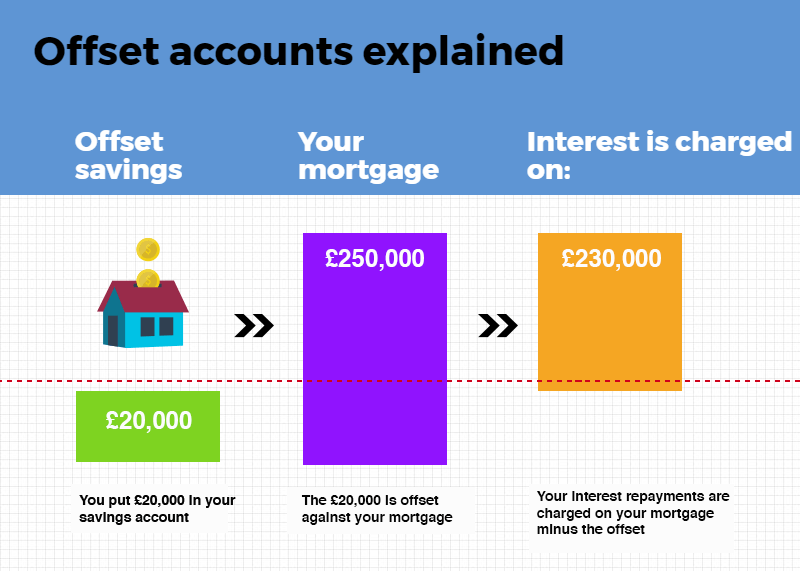

An offset mortgage account is one in which you put all of your accounts together and only pay interest on the difference between your liabilities and your assets. So if you had a $100,000 mortgage but a $20,000 balance in your checking account, interest would be charged on only $80,000 – the assets “offset” the liabilities. In many cases, the credit balance doesn’t earn any interest but you “save” what you would’ve paid in mortgage interest. This makes it effectively a tax free gain and very tax efficient. (these accounts are also known as current account mortgages)

A friend of mine, who lived in the UK for years, paid off her house very quickly (think 360K GBP in under 4 years) and was surprised something like this didn’t exist in the United States. She mentioned that the biggest “shock” in setting up an offset mortgage, hers was in a One Account by Virgin Direct (at the time) and RBS, because you just saw an enormous negative number. If you can imagine, logging into your bank account and seeing -£360,000 can be a bit of a shock day in and day out, but she ended up paying it down in under 4 years (at the time they had two incomes and no children).

I think part of the reason why these aren’t more popular in the United States is that banks don’t make money when you can pay off a mortgage so quickly, lenders can’t resell loans like this, and we’ve been “trained” by marketers to think we are supposed to have a house payment, like a car payment, all the time.